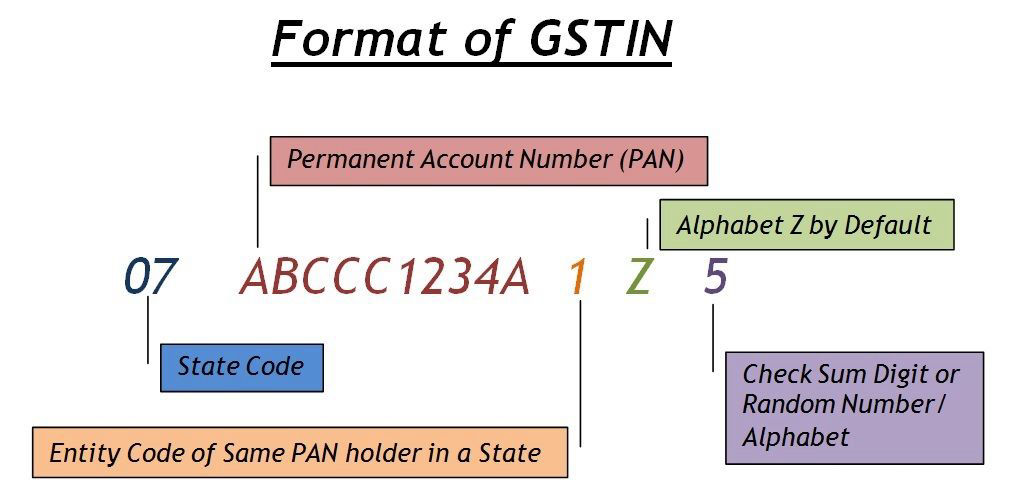

GSTIN stands for Goods and Services Tax Identification Number which is a PAN based unique number assigned to all the registered taxpayers for the purpose of GST compliance and administration.

Verification of GSTIN can be done on the common GST Portal

https://services.gst.gov.in/services/searchtp

Mobirise themes are based on Bootstrap 3 and Bootstrap 4 - most powerful mobile first framework. Now, even if you're not code-savvy, you can be a part of an exciting growing bootstrap community.

Choose from the large selection of latest pre-made blocks - full-screen intro, bootstrap carousel, content slider, responsive image gallery with lightbox, parallax scrolling, video backgrounds, hamburger menu, sticky header and more.

Sites made with Mobirise are 100% mobile-friendly according the latest Google Test and Google loves those websites (officially)!

Mobirise themes are based on Bootstrap 3 and Bootstrap 4 - most powerful mobile first framework. Now, even if you're not code-savvy, you can be a part of an exciting growing bootstrap community.

Choose from the large selection of latest pre-made blocks - full-screen intro, bootstrap carousel, content slider, responsive image gallery with lightbox, parallax scrolling, video backgrounds, hamburger menu, sticky header and more.

FOLLOW US!